Finwise Bancorp (FINW)·Q4 2025 Earnings Summary

FinWise Bancorp Caps Strong 2025 with Q4 Beat on Loan Originations

January 29, 2026 · by Fintool AI Agent

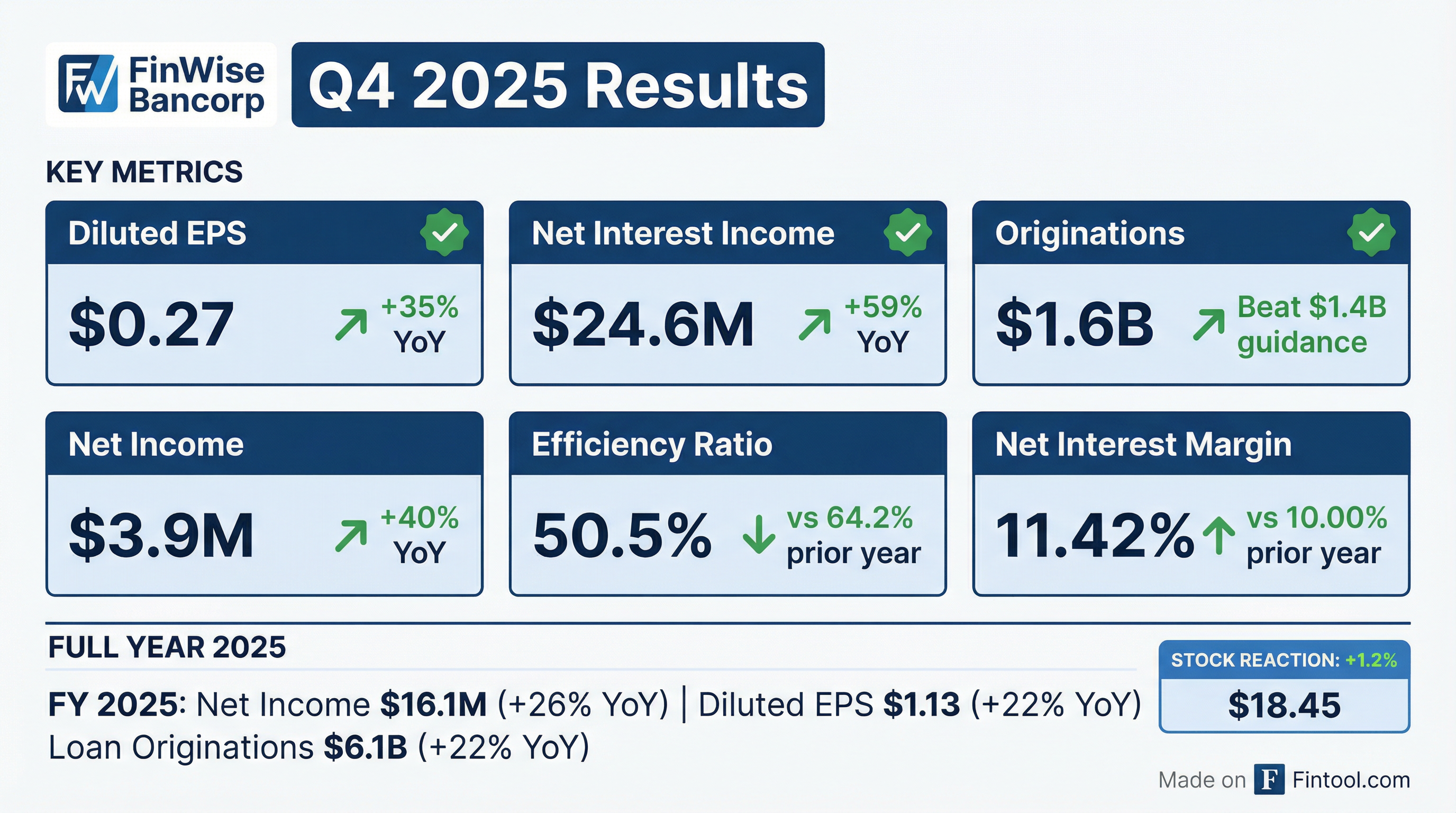

FinWise Bancorp (NASDAQ: FINW) reported Q4 2025 results that capped a strong fiscal year, with loan originations of $1.6 billion exceeding initial guidance of $1.4 billion and full-year net income growing 26% year-over-year. The stock rose 1.2% following the announcement, trading at $18.45.

Did FinWise Beat Earnings?

Q4 2025 results were mixed against estimates but strong versus prior year. Diluted EPS of $0.27 declined sequentially from $0.34 in Q3 2025 due to higher credit provisions related to Credit Enhanced portfolio growth, but increased 35% from $0.20 in Q4 2024.

Full year 2025 delivered strong results: net income of $16.1 million (+26% YoY), diluted EPS of $1.13 (+22% YoY), and loan originations of $6.1 billion (+22% YoY).

What Drove the Quarter?

Credit Enhanced Lending Momentum

The standout story in Q4 was the rapid expansion of FinWise's Credit Enhanced Lending program. Credit enhanced loan balances reached $118 million at year-end, ahead of management expectations and up from just $41 million in Q3 2025.

This product is lower risk because fintech partners maintain deposit accounts at FinWise that are used to recover charge-offs. The provision for credit losses on these loans is fully offset by credit enhancement income, creating a revenue-neutral credit model.

The $76.5 million increase in credit enhanced balances drove net interest income to $24.6 million (+32% QoQ, +59% YoY) and expanded net interest margin to 11.42% from 9.01% in Q3 2025.

Net Interest Margin Expansion

The NIM expansion was driven by credit enhanced portfolio growth carrying higher contractual interest rates, combined with falling deposit costs as rate cuts flow through.

What Did Management Say?

CEO Kent Landvatter struck an optimistic tone, emphasizing the company's multi-year investment thesis is now bearing fruit:

"FinWise delivered a strong 2025, growing net income 26% and posting a steady fourth quarter that demonstrates how our multiyear investments are gradually translating into tangible, sustainable results."

He highlighted key operational beats:

"Loan originations totaled a solid $1.6 billion in the fourth quarter, exceeding our initial guidance of $1.4 billion. This brings full year 2025 originations to $6.1 billion, representing a healthy 22% year-over-year growth."

On the Credit Enhanced program:

"We also experienced strong uptake of our credit-enhanced product, ending the quarter with balances of $118 million, exceeding both the $115 million outlook provided on our third quarter earnings call and our initial guidance of $50 million-$100 million."

On AI strategy:

"We are actively exploring opportunities to broaden the deployment of these capabilities across the company to drive efficiency and long-term value, with a disciplined focus on safeguarding sensitive data through secure and controlled implementation."

Management also announced the launch of DreamFi, a new fintech partnership serving underbanked communities.

What Changed From Last Quarter?

Sequential Decline in Net Income

While YoY metrics were strong, net income declined to $3.9 million from $4.9 million in Q3 2025. The primary driver was higher provision for credit losses ($17.7 million vs $12.8 million) related to Credit Enhanced portfolio growth.

However, this provision is offset by credit enhancement income in non-interest income, making it economically neutral. The accounting creates elevated gross numbers on both sides of the income statement.

Higher Effective Tax Rate

The effective tax rate increased to 28.7% in Q4 from 23.7% in Q3, due to limitations on compensation expense deductions for highly compensated individuals and interstate income apportionment changes.

Loan Origination Seasonality

Q4 originations of $1.6 billion declined from Q3's $1.8 billion due to seasonality in student lending programs, which see higher volumes during the back-to-school Q3 period.

One-Time Servicing Standards Impact

Bank CEO Jim Noone explained a refinement to servicing procedures that impacted Q4 results. Historically, FinWise allowed single 3-6 month deferments to stressed borrowers. In October, after reviewing performance data, they updated requirements to require full reunderwriting at time of deferment request.

"As a result, the level of NCOs in the quarter accelerated. It was appropriate to implement that proactively after we got the results of the back test... But we do not expect that level of NCOs from the core portfolio again, in the near term."

This change resulted in an after-tax EPS impact of $0.08 and should be viewed as a one-time event.

How Is Asset Quality Trending?

Asset quality metrics showed continued pressure from elevated interest rates affecting small business borrowers:

The elevated allowance ratio primarily reflects the credit enhanced loan portfolio, where the allowance is fully backed by partner guarantee assets. Excluding credit enhanced loans, the allowance was $14.4 million, relatively stable versus Q3's $14.6 million.

Nonperforming loans guaranteed by the SBA totaled $24.2 million of the $43.7 million total, providing significant loss protection.

How Did the Stock React?

FINW shares rose 1.2% on the earnings release, trading at $18.45. The stock has appreciated 8% from its 52-week low of $13.49 and trades 18% below its 52-week high of $22.49.

The stock trades at 1.3x tangible book value, reflecting premium valuation for the fintech-focused business model versus traditional community banks.

Capital and Balance Sheet

FinWise maintains strong capital levels well above regulatory requirements:

Balance sheet growth was funded primarily through time certificates of deposit, which increased to 63.4% of total deposits. Management noted increased noninterest-bearing demand deposits related to strategic program collateral deposits in anticipation of student loan fundings in January 2026.

What Was The Forward Guidance?

CFO Bob Wallman provided detailed guidance for 2026:

On originations seasonality: Management confirmed student lending seasonality will continue in 2026, with Q3 uptick expected as in prior years.

On CD funding costs: CFO noted deposits are tied to wholesale markets that move with Fed rates, with CD maturities of 3 months to 1 year blending in benefits gradually.

Q&A Highlights

Partner Recontracting Track Record

Bank CEO Jim Noone highlighted FinWise's strong partner retention:

"Recontracting historically has gone really well at FinWise. We've got 15 lending partners... Since 2016, I think we've had 3 partners in total that for one reason or another matriculated out of their partnership. 2 of them were during COVID—they were commercial lenders that went into COVID challenged and closed."

Contracts are typically 3-4 year initial terms with 2-year renewal options. Management noted no current concerns with upcoming renewals.

Fintech Charter Risk

On the trend of fintechs seeking bank charters, CEO Landvatter offered perspective:

"A banking charter is not really the best option for all fintechs... The most successful partners continually are those kind of in the middle of the bell curve, where they put up results year after year but probably aren't interested in growing to a size where they would need a bank charter."

He noted FinWise plans for partner turnover: "We've built a scalable platform that allows us to continually pursue new partnerships. We just plan for partners going away and partners coming on... We feel good about 2-3 a year."

SBA Business Outlook

On SBA demand following the government shutdown:

"SBA demand continues to be really solid in the pipeline versus last year. Originations for us were down a little bit in the quarter, but that was really just a timing delay from the shutdown rather than a demand issue. We had a nice pickup in closings already in January."

Cross-Sell Strategy

Management highlighted Tallied as an example of the cross-sell opportunity:

"Tallied, we signed last year and they've been a big contributor, but we signed them as a card sponsor partner. But we're also adding the credit-enhanced balance sheet flexibility for them, which really gives us upside."

Key Risks and Concerns

-

Fintech Partner Concentration: Revenue depends on strategic program relationships. Any partner financial difficulties could affect credit enhancement recoveries. Management noted they never over-rely on one partner for funding.

-

Interest Rate Sensitivity: Small business borrowers in the SBA portfolio have been pressured by elevated rates, driving nonperforming loan growth.

-

Regulatory Environment: Banking-as-a-service and fintech partnerships face evolving regulatory scrutiny.

-

Credit Quality Normalization: Net charge-offs increased, though partially due to more conservative servicing standards that are viewed as a one-time adjustment.

Looking Ahead

Management provided specific forward guidance:

-

Loan Originations: $1.4B quarterly baseline with 5% growth applied yields ~$5.9B FY 2026 outlook.

-

Credit Enhanced Expansion: Expect $8-10M monthly organic growth, potentially with variability between months.

-

SBA Portfolio: Expect SBA loan sales to approximately equal origination volume, keeping guaranteed balances stable.

-

Operating Leverage: Core expense run rate of $16M quarterly, with revenues expected to grow 2x faster than expenses.

-

Payments and BIN Sponsorship: While timing may be pushed out beyond initial expectations, management remains confident in the long-term strategy. Not expected to be hugely impactful in 2026, with more benefit coming in 2027.

-

AI Initiatives: Focusing on compliance, operations automation, policy alignment, regulatory compliance, and cybersecurity fraud detection.

Sources: FinWise Bancorp 8-K filed January 29, 2026; Q4 2025 Earnings Call Transcript; S&P Global Market Intelligence

View Full 8-K Filing | Earnings Call Transcript | Company Research